overleaf template galleryLaTeX templates and examples — Recent

Discover LaTeX templates and examples to help with everything from writing a journal article to using a specific LaTeX package.

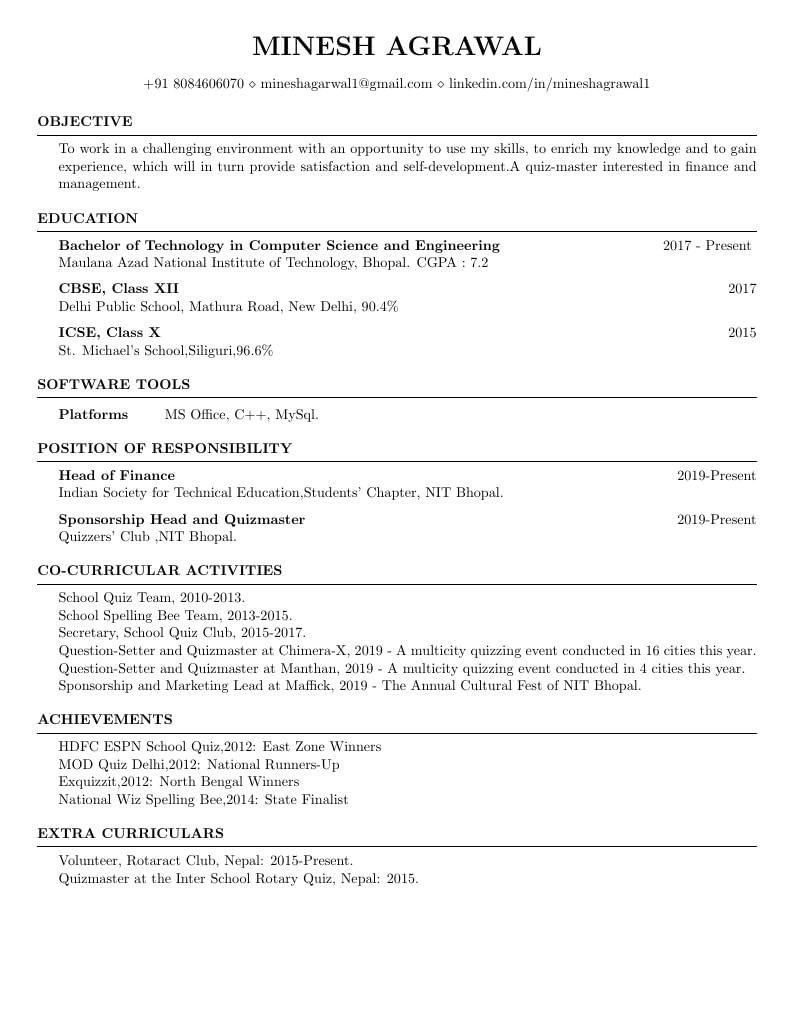

A quizmaster interested in finance and management. Created with the Medium Length CV template.

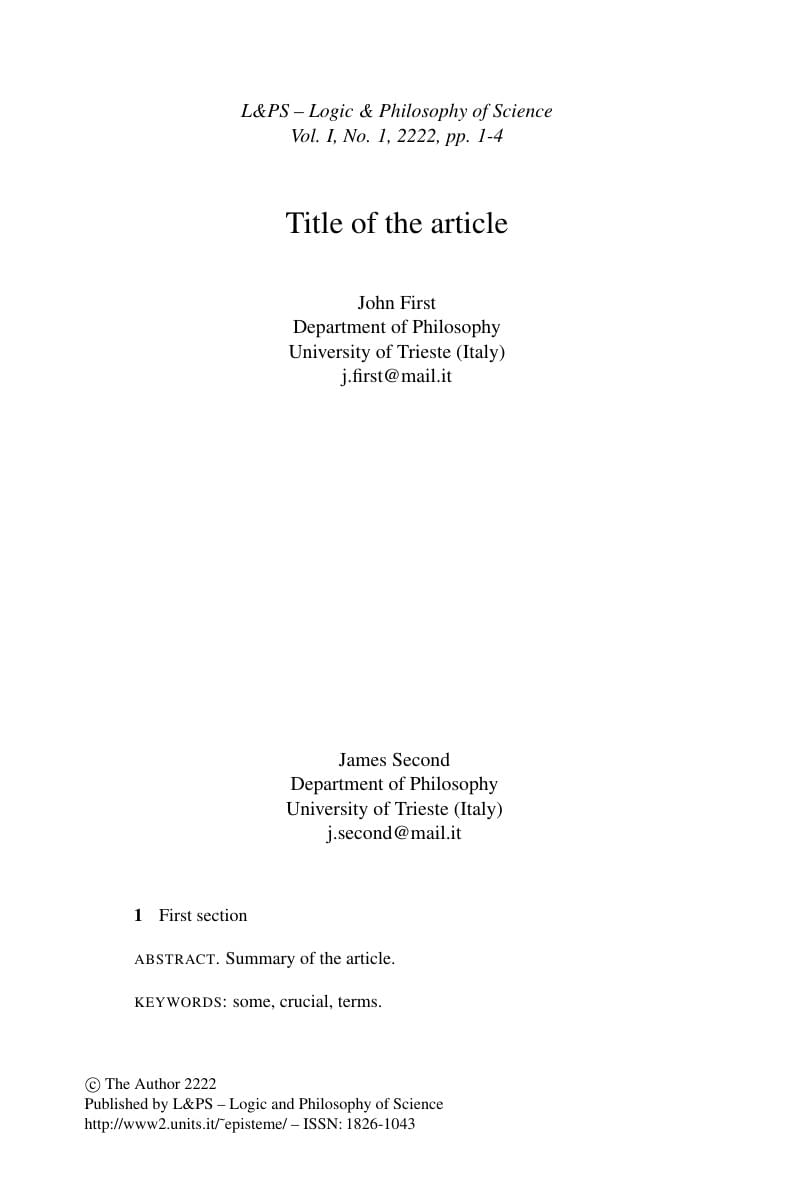

The Logic and Philosophy of Science (L&PS) journal is an online academic publication edited at the University of Trieste (Italy). The lps class allows LaTeX authors to write their articles conforming to the standards of this journal. Source: http://www.ctan.org/tex-archive/macros/latex/contrib/lps/. This template was originally published on ShareLaTeX and subsequently moved to Overleaf in November 2019.

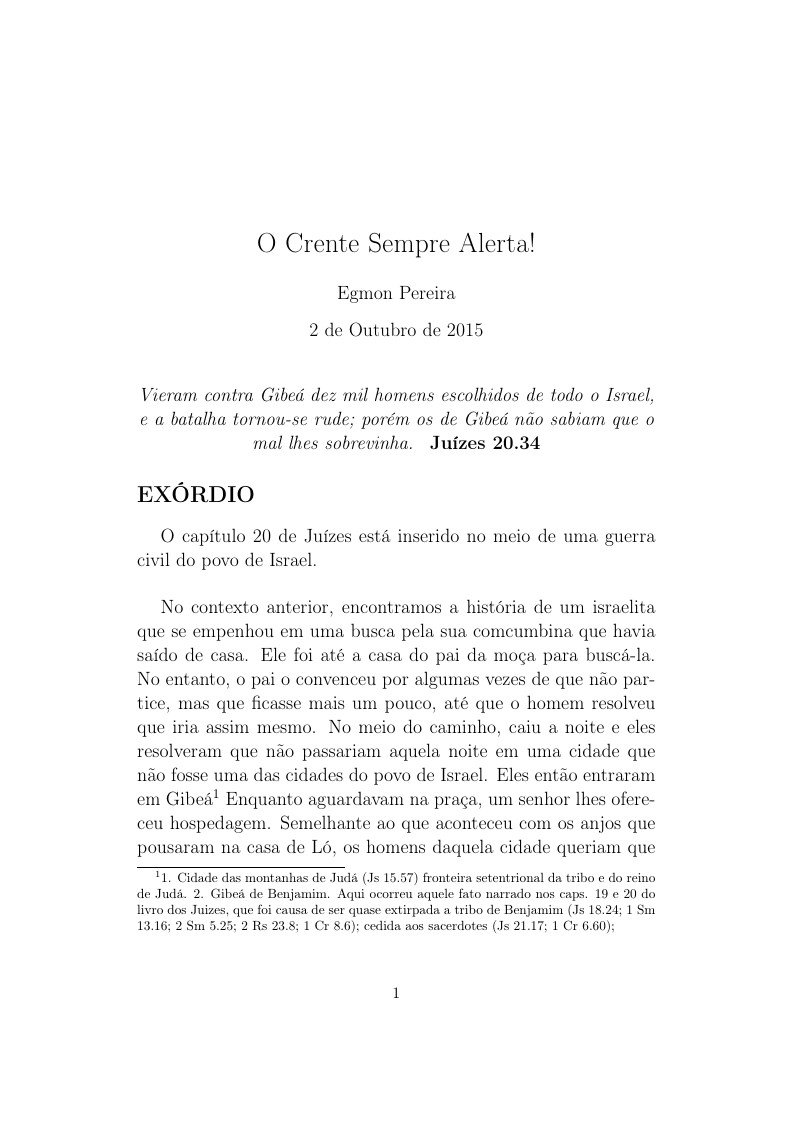

Sermão pregado na Igreja Presbiteriana do Primavera em 27 de setembro de 2015

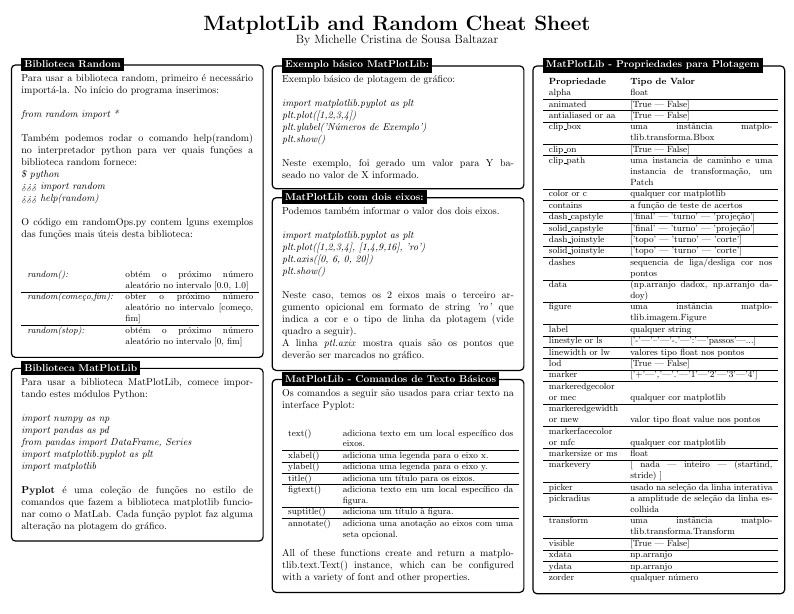

MatPlotLib and Random Cheat Sheet Edited by Michelle Cristina de Sousa Baltazar http://matplotlib.org/api/pyplot_summary.html http://matplotlib.org/users/pyplot_tutorial.html

Plantilla para presentaciones de ingeniería de sistemas UniMinuto 2019

Bachelor Thesis Template for Indian Institute of Technology Kharagpur (IIT KGP)

Various useful NTU-specific (La)TeX sources and templates: This is a template for graduate final exams in LaTeX.

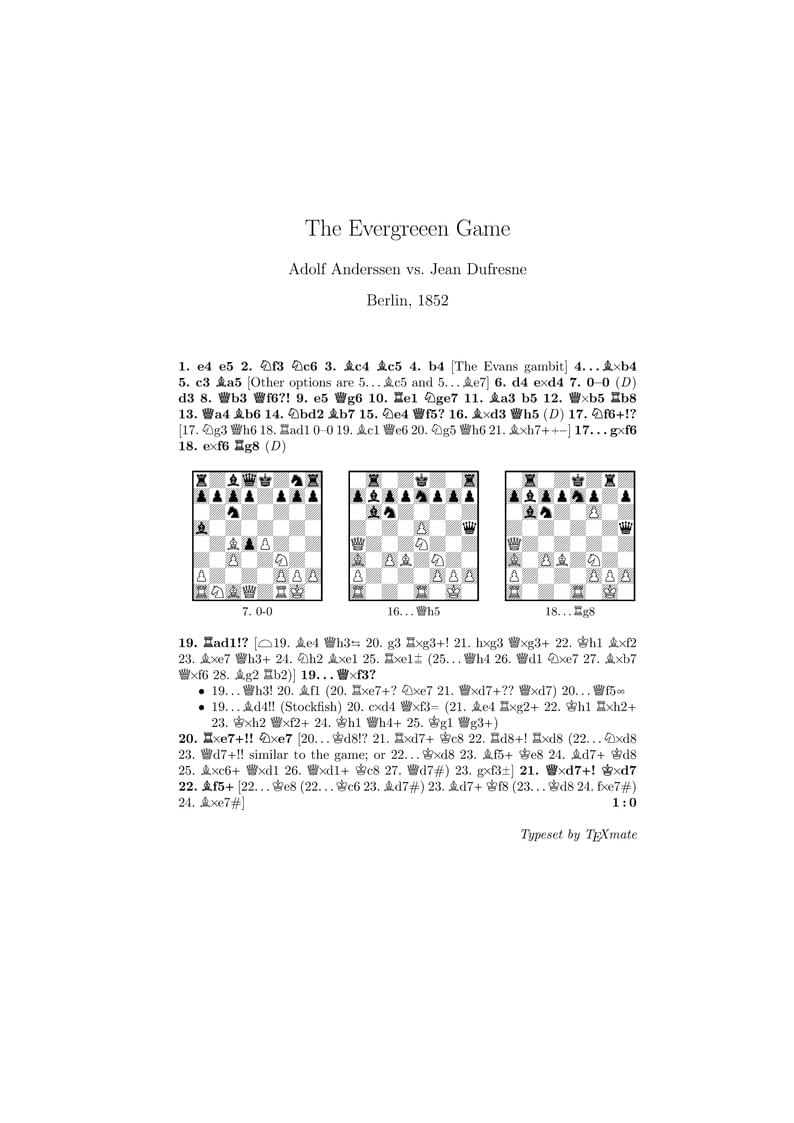

Sample of the use of TeXmate through the Evergreen game. Still important to read TeXmate's manual and official sample!

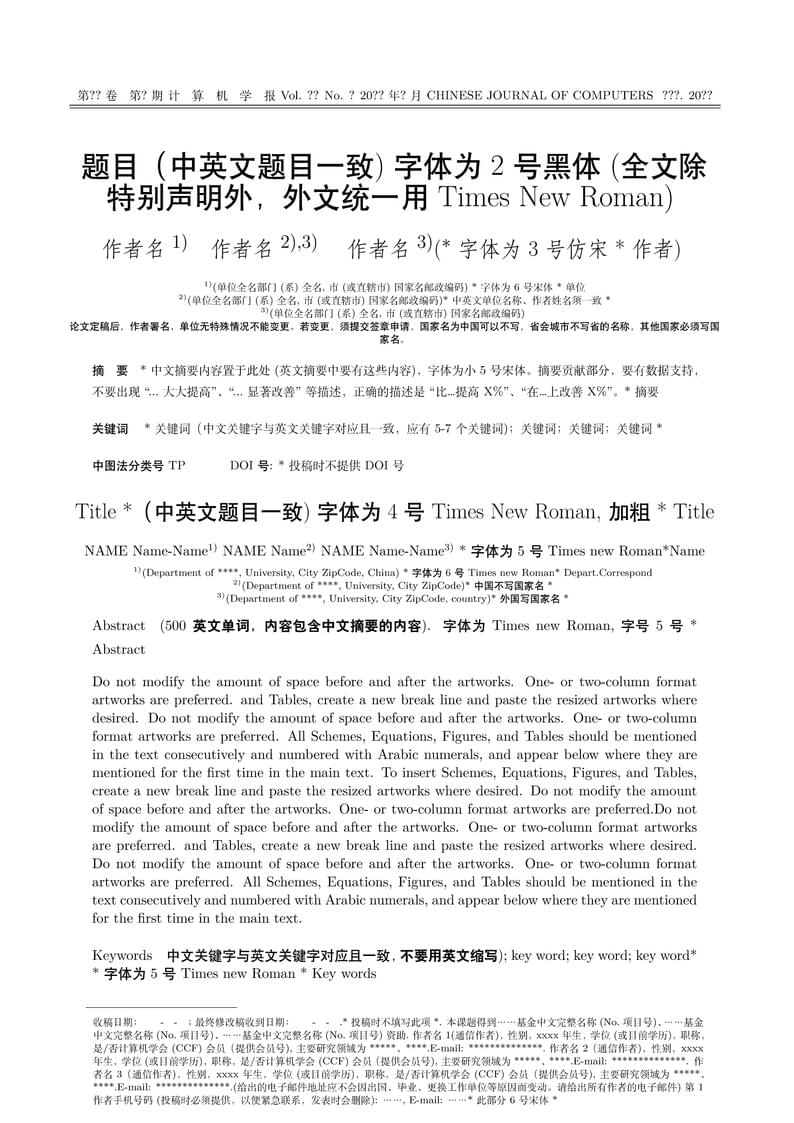

Chinese Journal of Computer Template

\begin

Discover why over 25 million people worldwide trust Overleaf with their work.